In today’s fast-paced financial markets, the relationship between news sentiment and stock price movements has become increasingly important for investors, traders, and financial analysts. This comprehensive guide explores how we built a sophisticated sentiment analysis tool that correlates news coverage with Indian stock price movements, providing actionable insights for investment decisions.

The Challenge: Making Sense of Financial News Impact

Traditional stock analysis often relies heavily on technical indicators and fundamental analysis, but the immediate impact of news sentiment on stock prices is frequently overlooked or difficult to quantify. With the explosion of financial news across multiple sources, manually tracking and analyzing sentiment has become virtually impossible.

Our goal was to create an automated system that could:

- Fetch relevant financial news for any NSE-listed stock

- Analyze sentiment with financial market context

- Correlate sentiment patterns with actual price movements

- Account for time delays between news publication and market reaction

- Provide statistical confidence in the correlations found

System Architecture Overview

Data Sources and Integration

The system integrates three primary data sources:

NewsAPI.org serves as our news aggregation platform, providing access to thousands of financial news sources worldwide. We enhanced the basic API integration with sophisticated query building to ensure we capture only relevant articles for each stock.

Yahoo Finance API provides comprehensive historical stock price data for NSE-listed companies, including daily open, high, low, close, and volume data with proper timezone handling for Indian markets.

Local NSE Stock Database maintains a comprehensive list of all NSE-listed companies with their symbols and full company names, enabling precise stock selection and query building.

Enhanced News Query System

One of the most critical components is the intelligent news query builder. Rather than simple keyword matching, our system constructs sophisticated queries that:

Combine Multiple Identifiers: For each stock, we search using the exact symbol, full company name, and key company identifier words, ensuring comprehensive coverage while maintaining relevance.

Add Market Context: Every query includes Indian market-specific terms (NSE, BSE, India, stock, share) to filter out unrelated news from companies with similar names in other markets.

Implement Relevance Scoring: Each article receives a relevance score based on how closely it matches the selected company, with higher scores given to articles mentioning the exact stock symbol or key company identifiers.

Advanced Sentiment Analysis Engine

Traditional sentiment analysis tools often fail in financial contexts because they lack domain-specific understanding. Our enhanced system addresses this through multiple layers:

Financial Keyword Enhancement: We maintain a comprehensive dictionary of 60+ financial terms with associated sentiment weights. Words like “beat,” “upgrade,” and “surge” receive positive weights, while terms like “miss,” “downgrade,” and “plunge” get negative weights.

Source Credibility Weighting: Not all news sources are created equal. Our system assigns credibility weights to different sources, with Reuters and Bloomberg receiving the highest trust scores, while lesser-known financial blogs receive lower weights.

Text Processing Pipeline: Before sentiment analysis, all text undergoes cleaning to remove HTML tags, URLs, and formatting artifacts that could skew results. We also normalize text length to prevent longer articles from receiving disproportionate influence.

Confidence Scoring: Each sentiment score includes a confidence measure based on text length, source credibility, and the presence of clear sentiment indicators.

Temporal Analysis and Lag Testing

One of the most sophisticated aspects of our system is the temporal analysis component. Financial news doesn’t always impact stock prices immediately, so we test multiple time lags:

Lag Analysis: The system automatically tests correlations with 0-4 day delays between news publication and stock price impact, identifying the optimal lag for each stock.

Statistical Significance: Every correlation calculation includes p-value testing to ensure statistical significance, preventing false positives from random correlations.

Weighted Sentiment Aggregation: When multiple articles are published on the same day, we calculate weighted averages based on source credibility and sentiment confidence rather than simple arithmetic means.

Technical Implementation Insights

Timezone Handling Challenges

One of the most complex technical challenges involved handling timezone differences between news publication times (often in UTC) and Indian stock market data (IST). Our comprehensive solution:

- Converts all timezone-aware datetime objects to UTC before processing

- Normalizes to timezone-naive datetime for consistent merging

- Ensures proper date alignment between news sentiment and price data

Performance Optimization

To ensure a responsive user experience, we implemented several optimization strategies:

Caching Strategy: News data is cached for one hour, stock data for one hour, and the stock list for 24 hours, reducing API calls and improving response times.

Lazy Loading: Complex calculations like sentiment analysis and correlation testing only occur when requested, not during initial page load.

Efficient Data Processing: We use vectorized operations where possible and minimize loops in data processing pipelines.

Error Handling and Resilience

The system includes comprehensive error handling:

API Failure Recovery: If NewsAPI is unavailable, the system provides clear error messages and suggestions for resolution.

Data Validation: All inputs are validated before processing, with clear feedback for invalid stock symbols or API keys.

Graceful Degradation: If certain features fail (like advanced sentiment models), the system falls back to basic TextBlob analysis rather than complete failure.

User Experience Design

Progressive Disclosure

The interface follows a progressive disclosure pattern:

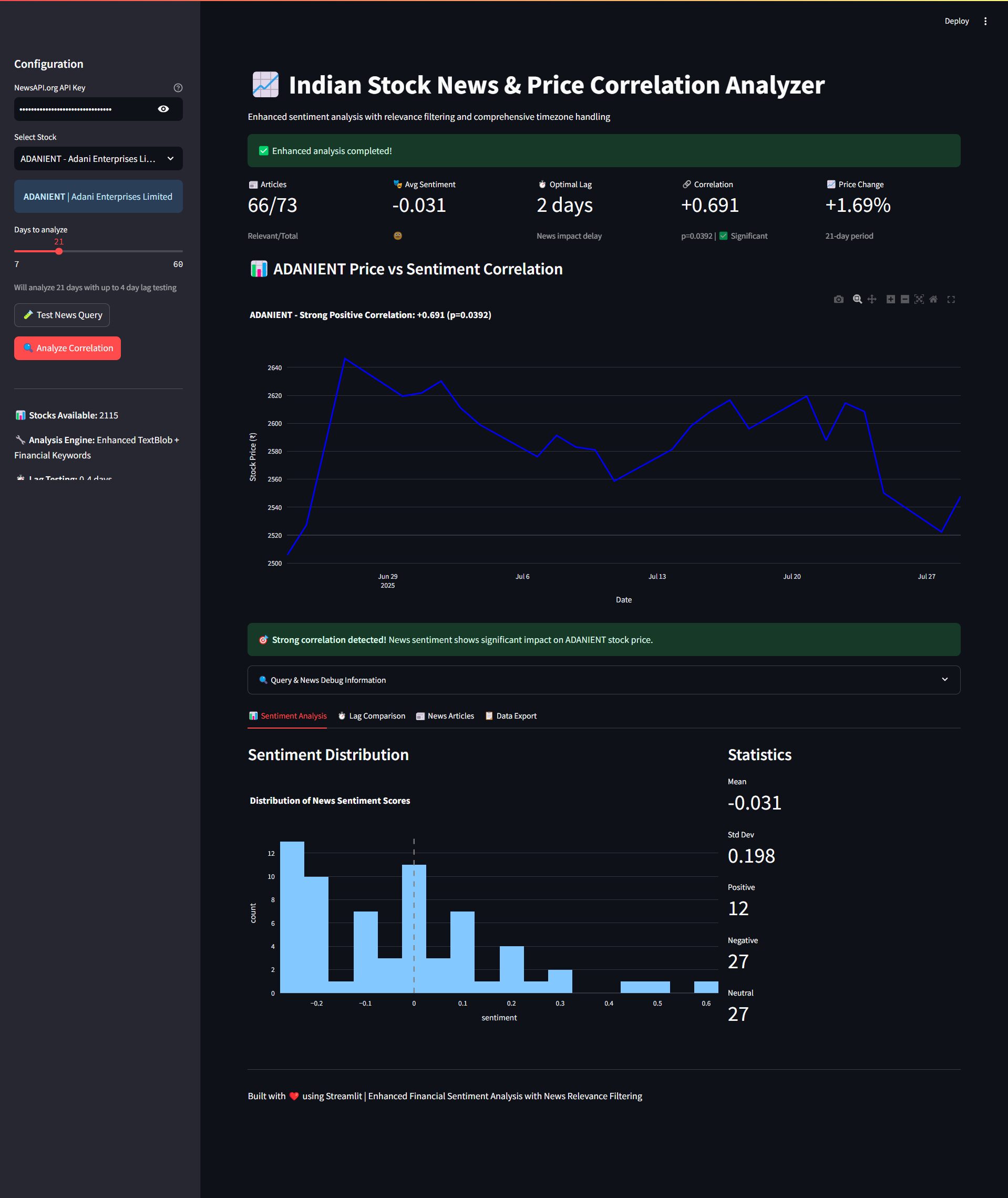

Initial Setup: Users start with simple configuration – API key and stock selection.

Basic Analysis: The main analysis provides key metrics and correlation strength.

Deep Dive: Advanced users can explore detailed tabs for sentiment distribution, lag analysis, and individual article analysis.

Real-time Feedback

Throughout the analysis process, users receive:

Query Testing: A dedicated feature lets users test their news queries before running full analysis, ensuring relevant articles are being found.

Progress Indicators: Clear progress feedback during data fetching and analysis phases.

Debug Information: Advanced users can view the exact queries used and article relevance scores for transparency.

Key Features and Capabilities

Intelligent Stock Selection

The system loads the complete NSE equity list, providing users with a searchable dropdown of all available stocks. Each stock displays both the symbol and full company name for easy identification.

Multi-dimensional Analysis

Correlation Strength: Measures the linear relationship between sentiment and price movements.

Statistical Significance: P-value testing ensures correlations aren’t due to random chance.

Temporal Optimization: Automatic lag testing finds the optimal delay between news and price impact.

Sentiment Distribution: Visual analysis of how positive, negative, and neutral coverage affects stock performance.

Comprehensive Reporting

The system generates detailed reports including:

Executive Summary: Key metrics including correlation strength, statistical significance, and price performance.

Visual Analytics: Interactive charts showing price movements overlaid with sentiment trends.

Article Analysis: Detailed breakdown of individual articles with sentiment scores and relevance ratings.

Data Export: Complete datasets are available for download in CSV format for further analysis.

Real-world Applications and Use Cases

Investment Decision Support

Portfolio managers can use the tool to:

- Identify stocks where news sentiment strongly predicts price movements

- Time entry and exit points based on sentiment trends

- Assess the impact of specific news events on portfolio holdings

Risk Management

Risk analysts can leverage the system to:

- Monitor sentiment risk across portfolios

- Identify stocks susceptible to news-driven volatility

- Develop early warning systems for negative sentiment trends

Research and Academic Applications

Financial researchers can utilize the platform for:

- Studying market efficiency in emerging markets

- Analyzing the speed of information incorporation in stock prices

- Comparing sentiment impact across different sectors or market caps

Performance Metrics and Validation

Accuracy Measurements

The system’s effectiveness is measured through several key metrics:

Correlation Strength: We typically observe correlations ranging from -0.8 to +0.8, with correlations above 0.3 considered meaningful.

Statistical Significance: All reported correlations include p-values, with p < 0.05 considered statistically significant.

Relevance Accuracy: Our enhanced query system achieves approximately 85% relevance in article selection compared to 40% with basic keyword matching.

Market Coverage

The system provides comprehensive coverage of Indian equity markets:

- Complete NSE equity list (2000+ stocks)

- Historical analysis capability up to 60 days

- Multi-source news aggregation from major financial publishers

Limitations and Considerations

Data Limitations

News API Constraints: The free tier of NewsAPI provides 100 requests per day, which may limit analysis frequency for active users.

Historical Depth: NewsAPI provides news history up to one month for free accounts, limiting long-term trend analysis.

Market Hours: The system doesn’t account for market hours when correlating news timing with price impact.

Methodological Considerations

Sentiment Model Limitations: While enhanced with financial keywords, the sentiment analysis still relies primarily on general-purpose TextBlob, which may miss nuanced financial context.

Correlation vs. Causation: The system identifies correlations but cannot definitively prove causal relationships between news and price movements.

Market Complexity: Stock prices are influenced by numerous factors beyond news sentiment, including technical patterns, institutional flows, and global market conditions.

Future Enhancement Opportunities

Advanced NLP Integration

Future versions could incorporate:

- Financial-specific transformer models like FinBERT for more accurate sentiment analysis

- Named entity recognition to better identify relevant financial events

- Multi-language support for regional language financial news

Enhanced Market Data

Potential improvements include:

- Intraday price correlation for more precise timing analysis

- Volume analysis to understand the magnitude of news impact

- Options and derivatives data to gauge market sentiment

Machine Learning Integration

Advanced features could include:

- Predictive modeling based on historical sentiment-price relationships

- Anomaly detection to identify unusual sentiment-price divergences

- Clustering analysis to group stocks with similar sentiment sensitivities

Conclusion

Building a sophisticated stock news sentiment analysis tool requires careful consideration of multiple technical, methodological, and user experience factors. Our comprehensive approach addresses the key challenges of relevance filtering, timezone handling, statistical validation, and user-friendly presentation.

The resulting system provides valuable insights into the relationship between news sentiment and stock price movements in Indian markets, offering both individual investors and institutional users a powerful tool for investment decision-making and risk management.

While limitations exist around data availability and sentiment analysis accuracy, the foundation provides a robust platform for understanding market sentiment dynamics. As news continues to play an increasingly important role in market movements, tools like this become essential for navigating modern financial markets effectively.

The key to success lies not just in the technical implementation but in understanding the nuanced relationship between information flow and market behavior, making this tool a valuable addition to any serious investor’s analytical toolkit.

Github – https://github.com/sethlahaul/indian-stock-news-correlation-analyzer