A complete guide to creating a powerful web application for mutual fund analysis and SIP planning

Introduction

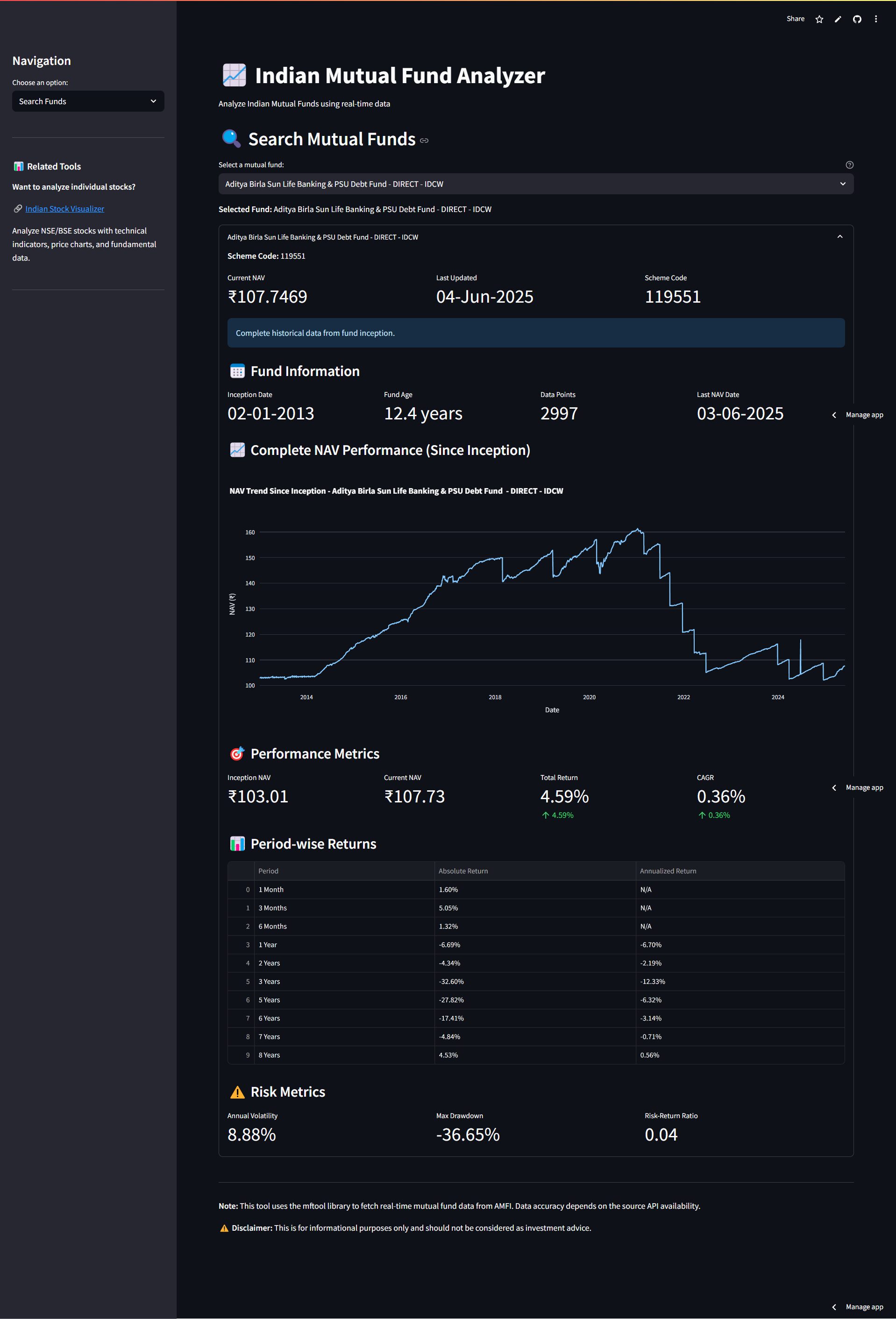

In today’s investment landscape, making informed decisions about mutual funds is crucial for building wealth. With thousands of mutual fund schemes available in India, analyzing their performance, calculating potential returns, and planning systematic investments can be overwhelming for retail investors.

This comprehensive guide walks you through building a feature-rich Indian Mutual Fund Analyzer using Python and Streamlit. Our application not only analyzes mutual fund performance from inception but also includes sophisticated SIP (Systematic Investment Plan) calculators and goal-based investment planning tools.

What We’re Building

Our application includes three main components:

- Mutual Fund Search & Analysis – Real-time fund data, performance metrics, and risk analysis

- SIP Calculator – Future value calculations and target-based planning

- SIP Goal Planner – Multi-goal investment planning with visual analytics

Technical Architecture

Core Dependencies

import streamlit as st import pandas as pd from mftool import Mftool import plotly.express as px import plotly.graph_objects as go from datetime import datetime, timedelta

Key Libraries:

- Streamlit: Web framework for rapid app development

- mftool: Python library for Indian mutual fund data from AMFI

- Plotly: Interactive visualization library

- Pandas: Data manipulation and analysis

Application Structure

The application follows a clean, modular structure:

├── Configuration & Setup ├── Data Fetching & Caching ├── Navigation System ├── Fund Analysis Module ├── SIP Calculator Module ├── Goal Planning Module └── UI Components & Styling

Feature Deep Dive

1. Mutual Fund Analysis Engine

Real-time Data Integration

The heart of our application is the integration with the mftool library, which provides real-time data from AMFI (Association of Mutual Funds in India):

@st.cache_resource

def get_mf_tool():

return Mftool()

The @st.cache_resource decorator ensures we don’t repeatedly initialize the connection, improving performance significantly.

Smart Historical Data Fetching

One of the most challenging aspects was fetching complete historical data from fund inception. Our solution uses a smart fallback mechanism:

# Try to get maximum historical data available

for years_back in range(max_years_back, 0, -1):

try:

start_date = end_date - timedelta(days=365 * years_back)

historical_data = mf.get_scheme_historical_nav(

code,

start_date.strftime('%d-%m-%Y'),

end_date.strftime('%d-%m-%Y')

)

if historical_data and 'data' in historical_data:

break

except:

continue

This approach ensures we get the maximum available data while gracefully handling API limitations.

Comprehensive Performance Metrics

Our analyzer calculates multiple performance indicators:

- CAGR (Compound Annual Growth Rate):

(((current_nav / inception_nav) ** (1/fund_age_years)) - 1) * 100 - Total Returns: Absolute returns since inception

- Period-wise Returns: 1 month, 3 months, 6 months, 1 year, 2 years, 3 years, 5 years

- Risk Metrics: Annual volatility, maximum drawdown, risk-return ratio

Advanced Risk Analysis

# Annual volatility calculation df['daily_return'] = df['nav'].pct_change() annual_volatility = df['daily_return'].std() * (252 ** 0.5) * 100 # Maximum drawdown calculation df['rolling_max'] = df['nav'].expanding().max() df['drawdown'] = (df['nav'] - df['rolling_max']) / df['rolling_max'] max_drawdown = df['drawdown'].min() * 100

2. SIP Calculator System

Future Value Calculator

Our SIP calculator uses the standard future value formula for annuities:

# SIP Future Value Formula: PMT * [((1 + r)^n - 1) / r] * (1 + r)

if monthly_rate > 0:

future_value = monthly_investment * (((1 + monthly_rate) ** total_months - 1) / monthly_rate) * (1 + monthly_rate)

Target-Based Planning

The reverse calculation helps users determine required SIP amounts:

# Required SIP Formula: Target Amount / [((1 + r)^n - 1) / r * (1 + r)]

if monthly_rate > 0:

required_sip = target_amount / ((((1 + monthly_rate) ** total_months - 1) / monthly_rate) * (1 + monthly_rate))

Interactive Visualizations

We use Plotly for creating engaging, interactive charts:

fig = go.Figure()

fig.add_trace(go.Scatter(x=chart_df['Year'], y=chart_df['Total Investment'],

mode='lines+markers', name='Total Investment',

line=dict(color='#ff6b6b', width=3)))

fig.add_trace(go.Scatter(x=chart_df['Year'], y=chart_df['Future Value'],

mode='lines+markers', name='Future Value',

line=dict(color='#4ecdc4', width=3)))

3. Goal-Based Investment Planning

Predefined Financial Goals

The application includes common financial goals with realistic default values:

goals = {

"Child's Education": {"amount": 2000000, "years": 15, "return": 12},

"Child's Marriage": {"amount": 1500000, "years": 20, "return": 12},

"Retirement Planning": {"amount": 10000000, "years": 25, "return": 12},

"Dream Home": {"amount": 5000000, "years": 10, "return": 12},

# ... more goals

}

Multi-Goal Optimization

Users can select multiple goals and see:

- Individual SIP requirements

- Total monthly investment needed

- Goal allocation visualization

- Timeline analysis

User Experience Design

Intuitive Navigation

The sidebar provides clear navigation between different modules:

option = st.sidebar.selectbox(

"Choose an option:",

["Search Funds", "SIP Calculator", "SIP Goal Planner"]

)

Progressive Disclosure

Complex information is revealed progressively using expandable sections:

with st.expander(f"Customize {goal}", expanded=False):

# Detailed customization options

Real-time Feedback

Loading states and progress indicators keep users informed:

with st.spinner("Fetching fund data..."):

# API calls and data processing

Performance Optimizations

Caching Strategy

Strategic use of Streamlit’s caching mechanisms:

@st.cache_resource # For expensive initialization @st.cache_data # For data processing

Efficient Data Processing

Pandas operations are optimized for performance:

df['date'] = pd.to_datetime(df['date'], format='%d-%m-%Y')

df['nav'] = pd.to_numeric(df['nav'])

df = df.sort_values('date')

Error Handling & Robustness

Comprehensive Error Handling

try:

# API calls

historical_data = mf.get_scheme_historical_nav(...)

if historical_data and 'data' in historical_data:

# Process data

else:

st.error("Historical data not available")

except Exception as e:

st.error(f"Error fetching fund data: {str(e)}")

Graceful Degradation

The application continues to function even when some data is unavailable, providing fallback options and clear error messages.

Deployment Considerations

Streamlit Cloud Deployment

The application is designed for easy deployment on Streamlit Cloud:

- Requirements.txt: Include all dependencies

- Page Configuration: Set at the top of the file

- Resource Management: Proper caching and cleanup

Performance Monitoring

Key metrics to monitor:

- API response times

- Data processing speed

- User interaction patterns

- Error rates

Code Quality & Best Practices

Clean Code Principles

- Single Responsibility: Each function has a clear purpose

- DRY (Don’t Repeat Yourself): Reusable components

- Clear Naming: Descriptive variable and function names

- Documentation: Comprehensive comments and docstrings

Security Considerations

- Input Validation: All user inputs are validated

- API Rate Limiting: Handled gracefully

- Error Information: Sensitive information is not exposed

Future Enhancements

Potential Improvements

- Portfolio Analysis: Multi-fund portfolio optimization

- Comparison Tools: Side-by-side fund comparison

- Alert System: Performance-based notifications

- Export Features: PDF reports and Excel exports

- Mobile Optimization: Enhanced mobile experience

Technical Enhancements

- Database Integration: Store historical data locally

- Advanced Analytics: Machine learning predictions

- Real-time Updates: WebSocket integration

- API Development: RESTful API for data access

Conclusion

This Indian Mutual Fund Analyzer demonstrates the power of Python and Streamlit for building sophisticated financial applications. By combining real-time data fetching, comprehensive analysis, and intuitive user interfaces, we’ve created a tool that empowers investors to make informed decisions.

The application showcases several advanced concepts:

- Real-time data integration with external APIs

- Complex financial calculations with proper mathematical formulas

- Interactive visualizations for better data comprehension

- Goal-based planning with multi-objective optimization

- Responsive design principles for web applications

Key Takeaways

- User-Centric Design: Always prioritize user experience and intuitive navigation

- Data Quality: Implement robust error handling and data validation

- Performance: Use caching and optimization techniques effectively

- Scalability: Design with future enhancements in mind

- Documentation: Maintain clear, comprehensive documentation

Github – https://github.com/sethlahaul/indian-mf-monitor

Streamlit app – https://indian-mutual-fund-analyzer.streamlit.app

Whether you’re a beginner learning Python web development or an experienced developer building financial applications, this project provides valuable insights into creating production-ready applications that solve real-world problems.

The complete source code and live demo showcase how modern Python tools can democratize access to sophisticated financial analysis, making investment planning accessible to everyone.