Creating an accurate income tax calculator for Indian taxpayers has become increasingly important with the evolving tax landscape. This comprehensive guide walks you through building a sophisticated tax calculator that handles both old and new tax regimes, incorporating all the latest changes from Budget 2025-26.

Understanding the Indian Tax Structure

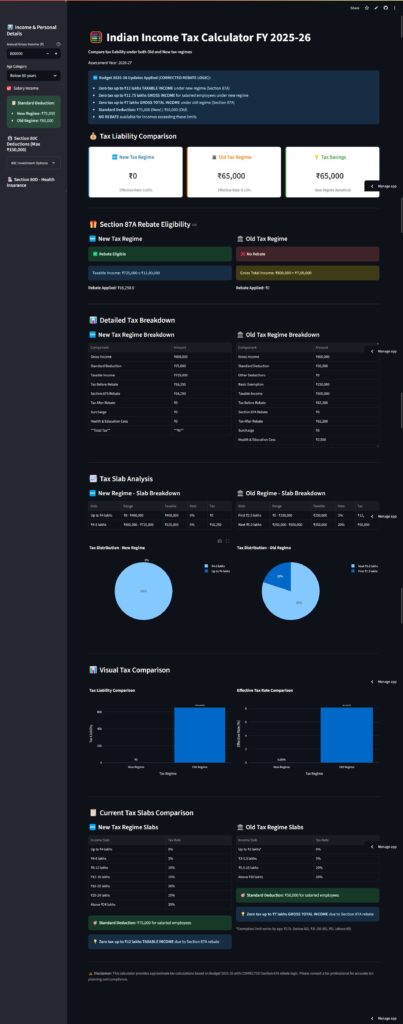

Current Tax Regimes

India currently operates under a dual tax regime system, allowing taxpayers to choose between:

- Old Tax Regime – Multiple deductions with higher tax rates

- New Tax Regime – Lower tax rates with limited deductions

The choice between regimes can significantly impact your tax liability, making an accurate calculator essential for informed decision-making.

Key Budget 2025-26 Updates

The latest budget introduced several crucial changes:

- Enhanced zero tax limit up to ₹12 lakhs taxable income under new regime

- Increased rebate amount to ₹60,000 under Section 87A

- Standard deduction of ₹75,000 for new regime and ₹50,000 for old regime

- Revised basic exemption limits for different age categories

Building the Tax Calculator Architecture

1. Configuration-Driven Design

The foundation of an effective tax calculator lies in its modular architecture. By separating configuration from logic, you ensure easy maintenance when tax laws change.

Core Configuration Elements

# Tax Slabs

NEW_REGIME_SLABS = [

(400000, 0.00), # Up to 4 lakhs - 0%

(400000, 0.05), # 4-8 lakhs - 5%

(400000, 0.10), # 8-12 lakhs - 10%

(400000, 0.15), # 12-16 lakhs - 15%

(400000, 0.20), # 16-20 lakhs - 20%

(400000, 0.25), # 20-24 lakhs - 25%

(float('inf'), 0.30) # Above 24 lakhs - 30%

]

# Basic Exemption Limits (Old Regime)

BASIC_EXEMPTION_LIMITS = {

"below_60": 250000, # ₹2.5 lakh

"senior_citizen": 300000, # ₹3 lakh

"super_senior": 500000 # ₹5 lakh

}

2. Deduction Management System

The old regime’s complexity lies in its extensive deduction options. A well-structured system should handle:

Major Deduction Categories

| Section | Description | Limit |

|---|---|---|

| 80C | Investment deductions | ₹1.5 lakh |

| 80D | Health insurance premiums | ₹1 lakh |

| 80E | Education loan interest | No limit |

| 80CCD(1B) | Additional NPS contribution | ₹50,000 |

| 80G | Charitable donations | Variable |

Implementation Strategy

- Categorized input collection for easy user navigation

- Real-time calculation of deduction limits

- Validation checks to prevent over-claiming

- Clear breakdown of how deductions are applied

3. Accurate Rebate Logic

One of the most critical aspects is implementing correct Section 87A rebate logic:

New Tax Regime Rebate

- Eligibility: Only for taxable income ≤ ₹12 lakhs

- Benefit: Complete tax elimination for eligible taxpayers

- No rebate: For incomes exceeding ₹12 lakhs taxable income

Old Tax Regime Rebate

- Eligibility: Only for gross total income ≤ ₹7 lakhs

- Benefit: Up to ₹25,000 rebate

- Calculation: Minimum of actual tax or ₹25,000

Technical Implementation Details

1. Slab-wise Tax Calculation

Implementing accurate slab-wise calculations requires careful handling of progressive taxation:

def calculate_tax_slab_breakdown(income, tax_slabs):

tax_breakdown = []

total_tax = 0

remaining_income = income

for slab_limit, rate in tax_slabs:

taxable_in_slab = min(remaining_income, slab_limit)

tax_in_slab = taxable_in_slab * rate

if taxable_in_slab > 0:

tax_breakdown.append({

'slab_range': f"₹{cumulative:,} - ₹{cumulative + slab_limit:,}",

'taxable_amount': taxable_in_slab,

'tax_rate': f"{rate*100:.0f}%",

'tax_amount': tax_in_slab

})

total_tax += tax_in_slab

remaining_income -= taxable_in_slab

2. Standard Deduction Handling

Proper standard deduction implementation differs between regimes:

- New Regime: ₹75,000 reduction from gross income before tax calculation

- Old Regime: ₹50,000 included in total deductions along with other Chapter VI-A deductions

3. Surcharge and Cess Calculation

For high-income taxpayers, additional levies apply:

Surcharge Slabs

| Income Range | Surcharge Rate |

|---|---|

| Up to ₹50 lakhs | 0% |

| ₹50L – ₹1 Cr | 10% |

| ₹1 Cr – ₹2 Cr | 15% |

| ₹2 Cr – ₹5 Cr | 25% |

| Above ₹5 Cr | 37% |

Health & Education Cess

- Rate: 4% on (Income Tax + Surcharge)

- Applies: To all taxpayers regardless of income level

User Experience Design

1. Intuitive Input Collection

Organize deduction inputs logically:

- Collapsible sections for different deduction categories

- Helpful tooltips explaining each deduction type

- Real-time validation with appropriate limits

- Progress indicators showing deduction utilization

2. Comprehensive Results Display

Present results in multiple formats:

- Summary cards showing final tax liability

- Detailed breakdowns with step-by-step calculations

- Visual comparisons between both regimes

- Slab-wise analysis with charts and tables

3. Educational Components

Include educational elements:

- Tax slab tables for both regimes

- Rebate eligibility indicators

- Regime recommendation logic

- Tax planning insights

Common Implementation Challenges

1. Rebate Calculation Errors

Challenge: Incorrectly applying rebate to ineligible taxpayers

Solution: Strict eligibility checks based on specific income thresholds

2. Basic Exemption Confusion

Challenge: Using incorrect exemption amounts

Solution: Reference official sources and validate against multiple authorities

3. Deduction Limit Management

Challenge: Complex interaction between different deduction limits

Solution: Implement hierarchical validation with clear priority rules

4. Age-based Calculations

Challenge: Properly handling different exemptions for various age groups

Solution: Create clear age category mappings with appropriate exemption amounts

Testing and Validation

1. Test Cases by Income Level

Create comprehensive test scenarios:

| Gross Income | Expected New Regime Tax | Expected Old Regime Tax |

|---|---|---|

| ₹5,00,000 | ₹0 | ₹0 |

| ₹10,00,000 | ₹0 | Variable (based on deductions) |

| ₹13,50,000 | ₹78,000 | ₹2,10,600 (minimal deductions) |

| ₹20,00,000 | ₹1,95,000 | Variable |

2. Edge Case Handling

Test boundary conditions:

- Exactly at rebate limits (₹12L for new, ₹7L for old)

- High-income scenarios with surcharge application

- Maximum deduction scenarios under old regime

- Different age categories with varying exemptions

3. Cross-validation

Verify calculations against:

- Official tax calculators from government sources

- Multiple tax advisory websites

- Manual calculations for simple scenarios

- Professional tax software outputs

Performance and Scalability

1. Efficient Calculation Logic

Optimize for performance:

- Avoid redundant calculations by caching intermediate results

- Use efficient data structures for tax slab processing

- Minimize API calls for real-time calculations

2. Responsive Design

Ensure accessibility across devices:

- Mobile-first design for smartphone users

- Progressive enhancement for desktop features

- Fast loading times with optimized assets

- Keyboard navigation support

Deployment and Maintenance

1. Configuration Management

Prepare for annual updates:

- Version-controlled tax configuration files

- Easy deployment process for budget changes

- Rollback capabilities for incorrect updates

- Testing pipelines for configuration changes

2. User Feedback Integration

Implement feedback mechanisms:

- Error reporting for calculation discrepancies

- Feature requests for additional deductions

- Usability improvements based on user behavior

- Regular updates reflecting tax law changes

Legal Considerations and Disclaimers

1. Accuracy Limitations

Always include appropriate disclaimers:

- Approximate calculations warning

- Professional consultation recommendations

- Regular updates notifications

- Source references for tax law changes

2. Data Privacy

Ensure user data protection:

- No storage of sensitive financial information

- Clear privacy policy regarding data usage

- Secure transmission for any required data

- User consent for optional features

Future Enhancements

1. Advanced Features

Consider implementing:

- Multi-year tax planning scenarios

- Investment recommendation engine

- Tax-loss harvesting calculations

- Retirement planning integration

2. Integration Possibilities

Explore connections with:

- Bank account data for automatic income detection

- Investment platforms for real-time portfolio values

- Expense tracking apps for deduction optimization

- Professional advisory services

Conclusion

Building an accurate Indian income tax calculator requires careful attention to the complex interplay of tax slabs, deductions, rebates, and exemptions. The key to success lies in:

- Modular architecture that separates configuration from logic

- Accurate implementation of all tax calculation rules

- Comprehensive testing against known scenarios

- User-friendly interface that educates while calculating

- Regular maintenance to reflect changing tax laws

By following this comprehensive guide and implementing proper validation checks, you can create a reliable tax calculator that helps Indian taxpayers make informed decisions about their tax regime choice and overall tax planning strategy.

The investment in building a robust tax calculator pays dividends through improved user trust, accurate calculations, and the ability to quickly adapt to changing tax regulations. Remember that tax laws evolve frequently, so building with flexibility and maintainability in mind is crucial for long-term success.

Link – https://indian-tax-calculator.streamlit.app

Github – https://github.com/sethlahaul/indian-tax-calculator